Get Business Mortgage

Unlock your business's potential with a tailored mortgage solution.

HOW TO QUALIFY FOR

Business Mortgage

Qualifying for a business mortgage can be a complex process, but it's definitely achievable with the right preparation and knowledge. Here's a breakdown of the key factors lenders consider and steps you can take to increase your chances of approval:

Business Finances

Annual revenue and profits

consistent track record of profitability

Cash

Cash flow, savings, and merchant account

Credit Score

Excellent credit score (690 or higher) is required.

Collateral

Available assets to secure a business mortgage

Here's what you can expect with our Business Mortgage services:

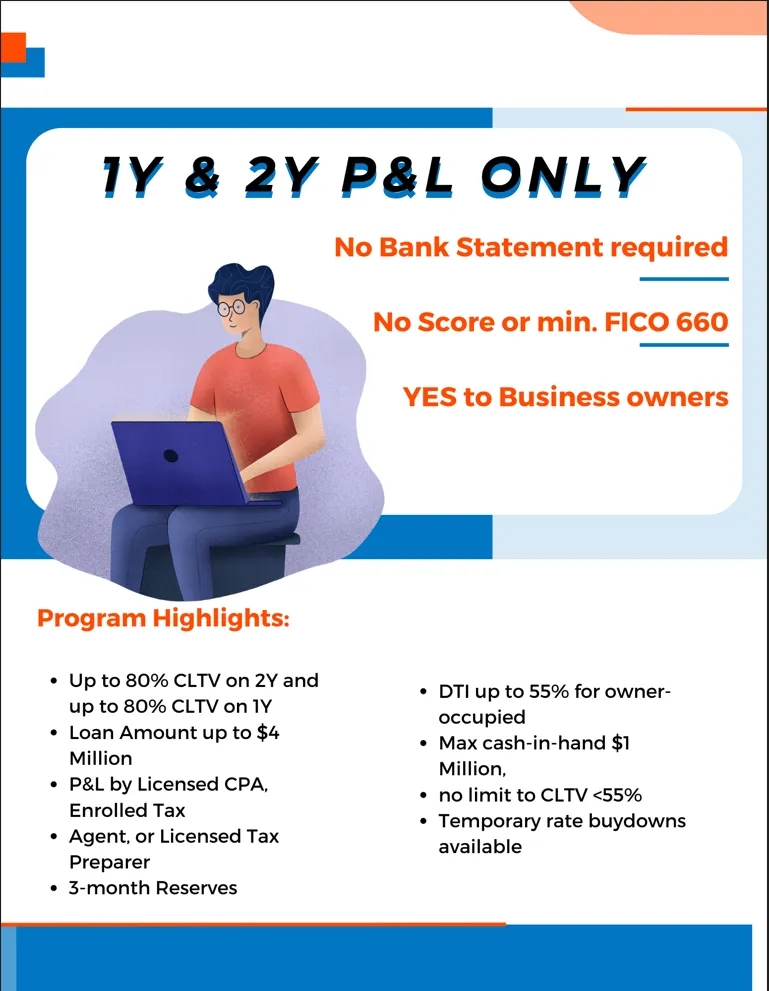

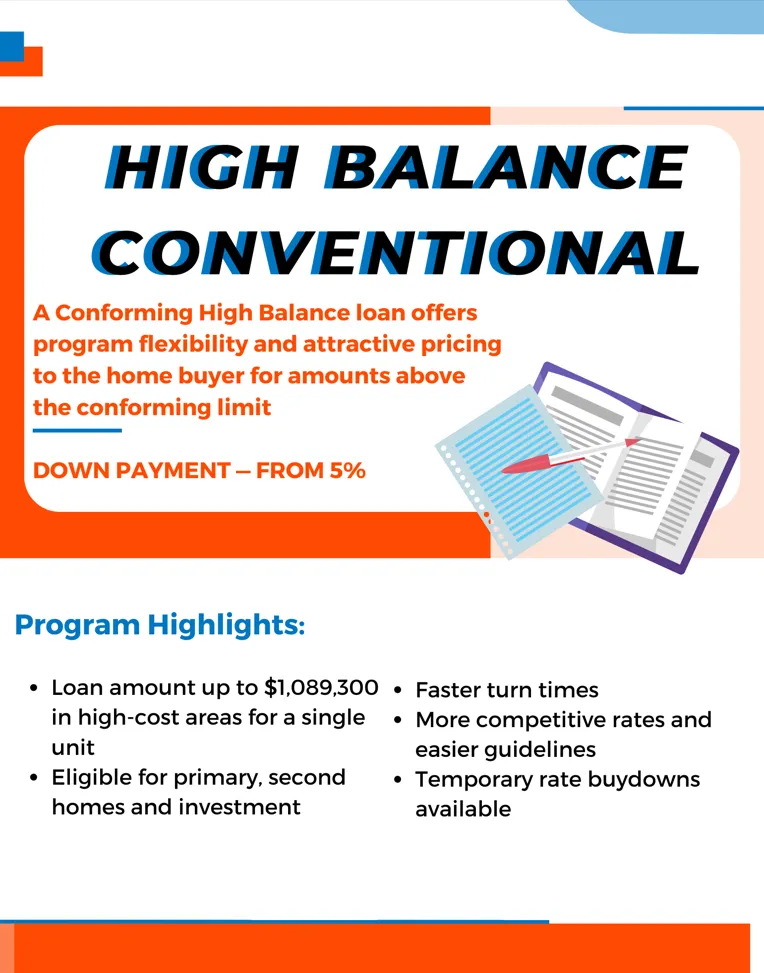

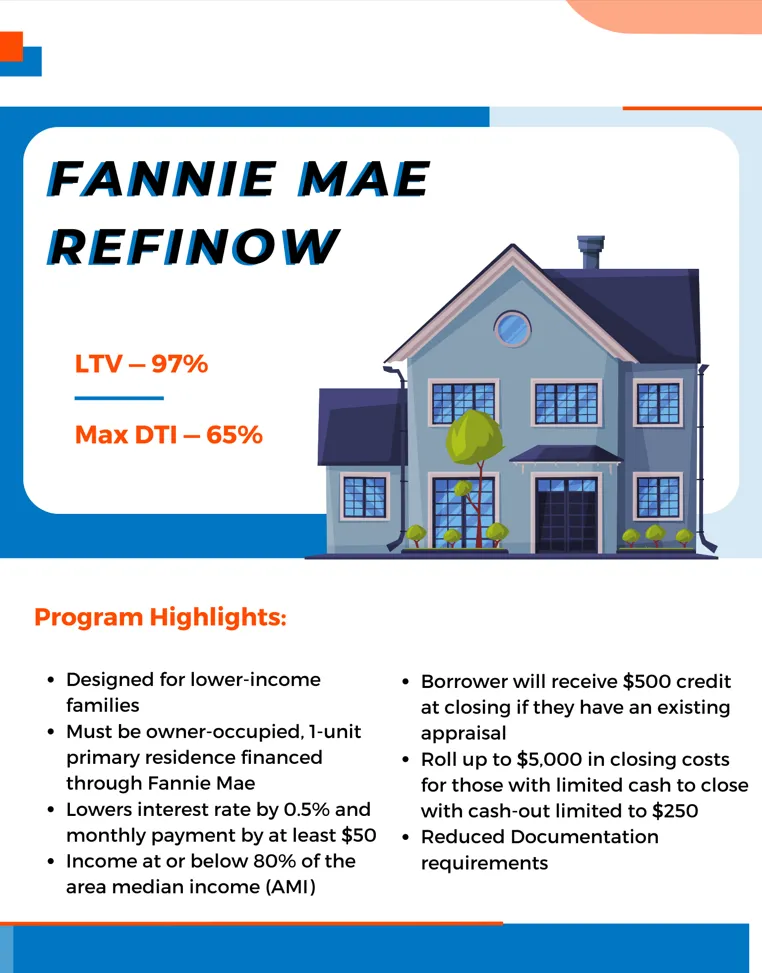

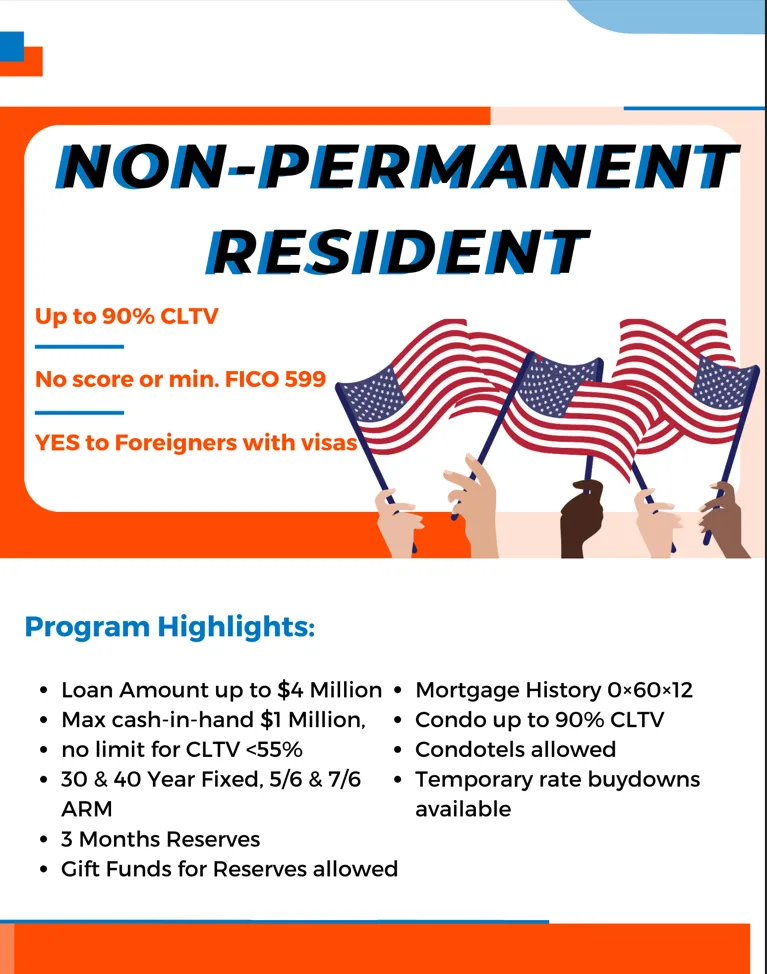

Business Mortgages For Your Situation

We can help you find the perfect mortgage to meet your specific needs and goals.

COMMON QUESTIONS

Frequently Asked Questions

Discover the world of business mortgage with our FAQs, covering key topics to help you make informed decisions and unlock growth opportunities.

How much mortgage can I afford?

This depends on several factors, including your income, debt, and down payment. A good rule of thumb is that your total monthly housing expenses should not exceed 28% of your gross monthly income. You can use a mortgage calculator to get a more accurate estimate of how much you can afford to borrow.

What is the difference between a fixed-rate and an adjustable-rate mortgage (ARM)?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An ARM has an interest rate that can fluctuate over time, based on a market index. ARMs typically have lower initial interest rates than fixed-rate mortgages, but the rate can increase over time, making your monthly payments higher.

What type of mortgage is right for me?

The best type of mortgage for you will depend on your individual circumstances. If you are looking for predictability and stability, a fixed-rate mortgage may be a good option. If you are comfortable with the possibility of your interest rate increasing in the future, an ARM may save you money in the short term.

Do I need to have a 20% down payment to get a mortgage?

While a 20% down payment is ideal, it is not always required. Many lenders offer conventional mortgages with down payments as low as 3%. If you put down less than 20%, you will likely be required to pay private mortgage insurance (PMI) until you reach 20% equity in your home.

What is private mortgage insurance (PMI)?

PMI is an insurance policy that protects the lender in case you default on your mortgage. You are typically required to pay PMI if you put down less than 20% on your home. PMI can add hundreds of dollars to your monthly mortgage payment.

What are the steps to getting a mortgage?

The steps to getting a mortgage can vary depending on the lender and the type of loan you are applying for. However, in general, the process will involve:

Getting prequalified

Shopping around for a mortgage lender

Putting in an offer on a home

Applying for a mortgage

Closing on the loan

What are the closing costs on a mortgage?

Closing costs are fees that you pay in addition to the purchase price of the home. These costs can include things like origination fees, appraisal fees, and title insurance. Closing costs typically range from 2% to 5% of the purchase price of the home.

Testimonials

Real results from business owners just like you

Cheryl Reisner,

a former bank lender from Shreveport, Louisiana. The suite’s business credit building process unlocked more funding options than she ever imagined, opening up new possibilities for her business. Cheryl believes every business owner can benefit from the Business Finance Suite, as it revolutionizes how they operate.

Louis,

a Miami-based business owner found success using the Business Finance Suite, which helped establish a business credit profile. This enabled them to apply for funding without using their Social Security number, eliminating personal liability for credit applications. The speaker highly recommends this program to fellow business owners.

Edward from El Paso, Texas, struggled to secure funding for his small businesses until discovering the Business Finance Suite. Within a month, the suite helped set up his business correctly, establish trade lines and revolving credit, and now he’s on track to receive funding. Edward guarantees it’s worth the investment and only wishes he’d found it sooner.

Brian

praises the Business Credit and Funding Suite for its exceptional service and support. Within 3 to 4 months, he was able to secure $50,000 in funding for his business and plans to refer more clients, grateful for the help he received.

Let's Find Your Funding

© 2023 VIP Consulting Innovations, LLCAll Rights Reserved. Privacy Policy.Terms and Conditions